Government bonds and treasury bills are popular investment options for those seeking stable returns and security. Treasury bills are short-term securities that are typically issued with maturities measured in days, such as 91, 182, or 364 days, emphasizing their short-term nature. These instruments are issued by the government and can be bought or sold through auctions, with the maturity date playing a crucial role in defining the type of bill. Government bonds, on the other hand, usually have longer maturities, often measured in years.

Investors interested in these securities can participate in auctions or purchase them on the secondary market. Information about available bonds, their yields, and maturity dates is often presented in a table format. Users may need to interact with the table, such as swiping left or expanding it, to view all the details. This ensures that investors have access to comprehensive data before making investment decisions.

Introduction to Turkish Investment Opportunities

Turkey emerges as an extraordinary gateway — a true beacon of opportunity — for discerning investors who genuinely seek to diversify their portfolios while tapping into a vibrant, growing market that pulses with potential. This remarkable country opens its arms to offer an impressive, robust selection of investment opportunities, with government bonds and treasury bills standing as the most cherished and popular choices among both local and international investors who understand value. These government debt securities — issued with unwavering commitment by the Turkish government to raise essential funds for national development and transformative public projects — provide not just a secure pathway, but a transparent and deeply reliable way for investors to truly participate in Turkey's remarkable economic growth story, becoming part of something meaningful and lasting.

Investors discover the beautiful flexibility of purchasing these bonds and treasury bills in either the local currency — the Turkish lira, which connects you directly to the heartbeat of the nation — or various foreign currencies, allowing for genuine adaptability based on your individual preferences and carefully considered risk profiles. The interest rates on these government debt securities are thoughtfully determined by the central bank, intimately tied to market expectations and the prevailing economic conditions that shape our financial landscape. This means that investors can genuinely benefit from competitive rates that authentically reflect the current financial climate in Turkey — rates that speak to the real opportunities available to those who choose to trust in this dynamic market.

Each bond or treasury bill comes with a clearly defined maturity date — a promise etched in stone — at which point investors receive complete repayment of their principal investment, just as committed from the very beginning. Throughout the entire life of your investment, you can confidently expect to receive regular coupon payments, providing that steady, dependable stream of income that brings peace of mind and financial stability. The process to acquire these securities is refreshingly straightforward and transparent — no hidden complexities or unwelcome surprises — and they are typically issued through well-organized auctions or direct sales, making it genuinely easy and accessible for investors to participate fully in the Turkish market with confidence and clarity.

Whether your vision encompasses investing in short-term treasury bills that offer quick returns or longer-term government bonds that provide sustained growth opportunities, Turkey's government debt market extends a comprehensive range of options designed to suit different investment strategies and financial dreams. With crystal-clear terms, absolutely reliable repayment schedules, and the solid backing of the Turkish government — a partnership you can trust completely — these bonds represent not just a stable investment vehicle, but an attractive and meaningful opportunity for those looking to grow their funds while exploring the genuine benefits of the Turkish market, where your financial future can truly flourish.

In Turkey, property transactions, like everywhere else, are accompanied by a collection of documents from both the buyer and the seller.

One such document is an Iskan, a building passport for the acquired property (flat, apartment, or commercial premises).

Tolerance Real Estate Agency explains why an Iskan is important for future property owners, what information it should contain, and what to focus on when studying this document.

What does an Iskan look like and why is it needed

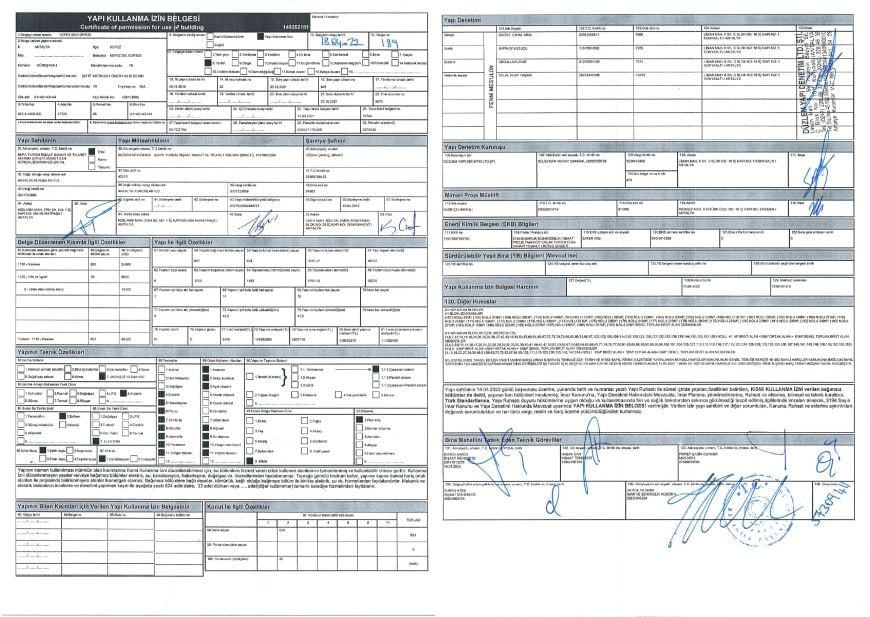

Iskan (its full name in Turkish is — Yapı kullanma izin belgesi) — is a building passport which is a printout on paper (not on an official form) of a table with information about the house or other property.

The back side is stamped and signed by a local municipality official.

The building passport certifies that the building is operational, and that it is fit for habitation or other activities (for example, commercial).

To get an Iskan, the developer or property owner should apply to the local municipality with the building's passport and also prove that the construction was built in accordance with urban development plan and meets construction regulations.

Important: an Iskan is only issued once, it cannot and should not be reissued, although a copy can be obtained if necessary.

If you are buying a flat on the secondary market, the previous owner should hand over the Iskan.

The owner's name is not mentioned in this document, as the purpose of an Iskan is to confirm that the flat or the building is habitable, not to affirm property rights.

Issuance of the TAPU (property deed) is entrusted to another department — the cadastre office.

Where will you require an Iskan?

Primarily, it's needed to conclude contracts for water, electricity, and gas supply - in other words, you can't set up utilities without this document.

This also applies to rental arrangements and issuing mortgages for this property.

Different types of Iskan

Due to changes in the legislation regarding building passports for real estate properties that took place in 2020, there's often confusion—flat purchasers do not understand which Iskan they specifically need.

Let's figure it out.

-

If a house (residential complex) was commissioned before 2020, it must have a Genel Iskan —a general technical passport for the entire building. This document specifies the condition of the whole building, including all flats, corridors, other spaces and denotes the landowner on whose land the building stands.

The signatures of the managing director of the building company and the chief engineer of the site are mandatory.

Before issuing the technical passport, an expert committee assesses compliance with building standards, including standards for earthquake resistance, the availability of fire extinguishing facilities, preparedness of access roads, usability of fire stairs and exits, shelters. The correspondence of all premises to the master plan is also checked.

Residential complexes without a Genel Iskan are considered unfit for people to live in, meaning, they are practically buildings whose construction has not been completed.

- Aside from the Genel Iskan, Ferdi Iskan used to be issued separately for each apartment until recently. Obtaining such a document was the responsibility of flat owners.

The document is an A4 sheet, filled on both sides. It contains information about the first property owner who applied for the Iskan issue, with information about the construction company, construction control supervisory bodies, the precise location of the property, and its technical parameters: floor, area.

To obtain this technical passport, the property owner provided the municipality with a TAPU, their passport, tax number and Genel Iskan, after which they paid a government fee ranging from 1,500 to 4,000 liras and awaited the readiness of the document for up to two weeks.

Following the introduction of new regulations, flat owners no longer need to acquire separate Iskans.

Now, the document is issued to the developer, and it is called Yapı Kullanma İzin Belgesi. It indicates the object location, number of floors, total building space and the area of apartments.

Overall, changes in legislation have simplified tasks for flat buyers: they no longer have to contact the municipality themselves and wait for up to two weeks until the technical passport is processed — the document is now with the developer, and it has the same power, namely, it confirms the suitability of the dwelling for inhabitation.

Just remember: some developers divide the Iskan price amongst all owners and may include it in the price of the flat immediately, otherwise, they may ask for an additional payment.

What to Consider When Buying a Flat in Turkey

Flats bought at the construction stage don’t yet have an Iskan — the house is not completed, not commissioned, so the developer will obtain the document later.

At the point of purchase, you can check for another important document - Yapı Ruhsatı — a construction permit showing the object address and technical characteristics.

Many purchasers wonder if it is possible that a built complex might not obtain an Iskan.

These risks are minimal, but they do exist. For instance, if the developer goes bankrupt and doesn’t complete the construction, or seriously exceeds the limits of the confirmed previous project.

The fact that the house is yet to be commissioned must be reflected in the real estate purchase agreement.

The completion timeframe for the work, assumed date of receiving the habitation permit, and the developer's responsibility if they fail to obtain the document within the set timeframe — which could result in contract termination, full refund and possible penalties or charges to the buyer — are all mentioned.

The construction progress of all projects in Turkey is monitored by a 'Yapı denetim', that is, special state-licensed firms appointed by the municipality.

If you're choosing an apartment in an already completed complex, the seller must have a habitation permit, known as an Iskan.

This could be a Yapı Kullanma İzin Belgesi (common for all apartments), or a Ferdi Iskan (if the house was built before 2020).

If the seller doesn't have an Iskan, they should contact the municipality and request a copy, providing the TAPU and the collective Iskan for the house.

The seller should ideally deal with this before the transaction, as the absence of an Iskan poses certain risks to the buyer:

- Possibly, a Genel Iskan was not obtained because the building was built with violations and does not meet seismic or fire safety standards.

Technical passports are not issued if construction companies have tax and social insurance fund debts. Flat owners in the complex can pay off these debts, after which they can apply for an Iskan. - The utility bills in a non-commissioned building are much higher than usual — a special tariff with increased rates is used for calculations.

Using the electricity directly from the building site can result in a heavy penalty from the energy supply company, which homeowners will have to pay.

Alternatively, the electricity from the building site might be insufficient for the house's consumption, leading to power surges which could damage air conditioners and other appliances. - After a given period, a building without an Iskan becomes illegal. In such cases, the municipality can decide to demolish the building or hand it over to another developer to rectify violations.

Such decisions are rare as authorities try to minimise damage to property buyers. A few years back, an amnesty programme for illegal constructions was launched.

In summary: an Iskan is a document that reflects the key information about a property.

Before 2020, a separate technical passport was given to the builder for the whole building, and then to apartment buyers for their respective properties. After 2020, only developers receive the Iskan.

If you want to forge a future in this wonderful country, you should approach the issue of document processing with the utmost care and responsibility.

The most reliable and straightforward way to become a home owner in Turkey, and ensure that the property complies with all norms and has all the necessary documents, is to consult a trusted agency. Tolerance Agency would be happy to assist you in this.

We'll be pleased to answer all your queries, please contact us on Whatsapp +90 (532) 158 42 44

If you're planning to relocate to Turkey permanently, contact our specialists, who will suggest the best options for your budget.

Also, subscribe to our YouTube channel and Instagram page to get information straight from the professionals!

Additional channel to communicate with us: Telegram

Tolerance Team | 20 years with you